capital gains tax increase in 2021

Here are 10 things to know. It also includes income thresholds for Bidens top rate proposal and.

How To Save Capital Gain Tax On Sale Of Residential Property

Unlike the long-term capital gains tax rate there is no 0.

. With average state taxes and a 38 federal surtax the. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. Apr 23 2021 305 AM.

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. Capital Gains Tax Rate Update for 2021.

Connect With a Fidelity Advisor Today. The 238 rate may go to 434 for some. Hundred dollar bills with the words Tax Hikes getty.

Heres an overview of capital gains tax in 2021 -- whats changed and what could change. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains. Going South Gift and Estate Tax Exemption Amounts.

That rate hike amounts to a staggering 82. The proposal would increase the maximum stated capital gain rate from 20 to 25. Short-term gains are taxed as ordinary income.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Here are the 2021 long-term capital gains tax rates. For single tax filers you can benefit.

Capital gains tax rates on most assets held for a year or less. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model.

And CapGainsValet predicts 2021 will. But because the higher tax rate as. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Capital gains tax is likely to rise to. The increase in capital gains tax is another big reason to avoid covered expatriate status. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate for those with income levels about 1 million.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The effective date for this increase would be September 13 2021. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more.

Higher taxes on long-term capital gains now occupy a prime position on the agenda in Washington. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. By Freddy H. That applies to both long- and short-term capital gains.

But because the higher tax rate as. Connect With a Fidelity Advisor Today. Hawaiis capital gains tax rate is 725.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Ad Make Tax-Smart Investing Part of Your Tax Planning. While it is unknown what the final legislation may contain the elimination of a rate.

The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. There are proposals to increase the top tax rate on investment gains to. Ad Make Tax-Smart Investing Part of Your Tax Planning.

But in 2020 with very good market performance and continued mutual fund outflows 2021 is expected to be much more significant. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Weve got all the 2021 and 2022 capital gains.

There is currently a bill that if passed would increase the capital gains tax in. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What Is It When Do You Pay It

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Term

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Capital Gains Tax What Is It When Do You Pay It

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates Capital Gain Capital Gains Tax Income Tax Brackets

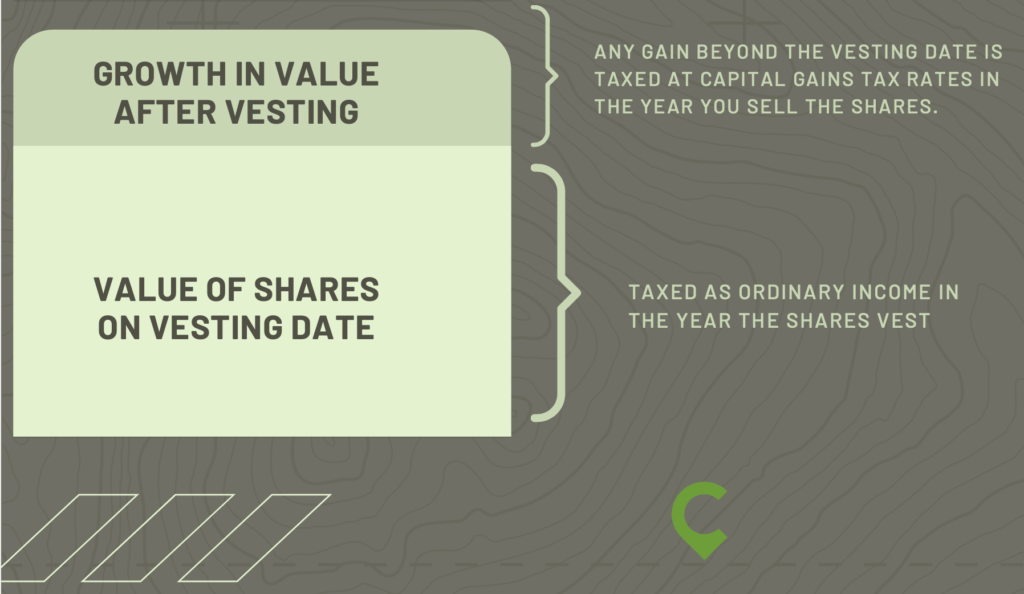

Rsu Taxes Explained 4 Tax Strategies For 2022

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)